Building Financial Partnerships That Matter

We work alongside independent financial consultants and corporate advisors who share our commitment to straightforward, effective budget strategy. These relationships help us support a wider range of businesses across Singapore.

Why Partners Choose Us

Most partnerships in financial services talk about synergy and alignment. Ours are simpler than that. We focus on practical collaboration that makes both our work and theirs more effective.

When independent consultants refer clients to us, they're looking for specialists who won't overcomplicate things. Their clients need budget planning support that actually helps them make decisions — not another report that sits in a drawer.

What Makes These Partnerships Work

- Clear communication channels between our teams and referring consultants

- Transparent process documentation so clients understand each planning stage

- Regular progress updates that keep everyone informed without excessive meetings

- Flexible engagement models that adapt to different business situations

We've found that the best partnerships happen when both parties respect each other's expertise. Financial consultants know their clients better than we ever could. We bring specialized budget planning knowledge that complements their broader advisory work.

Real Collaboration Patterns

Some consultants involve us during quarterly planning cycles. Others bring us in when their clients face specific challenges like expansion financing or operational restructuring. The timing varies, but the goal stays consistent: help businesses make informed financial decisions.

Partners Who Trust Our Approach

These financial professionals collaborate with us regularly, referring clients who need specialized budget planning support that complements broader advisory services.

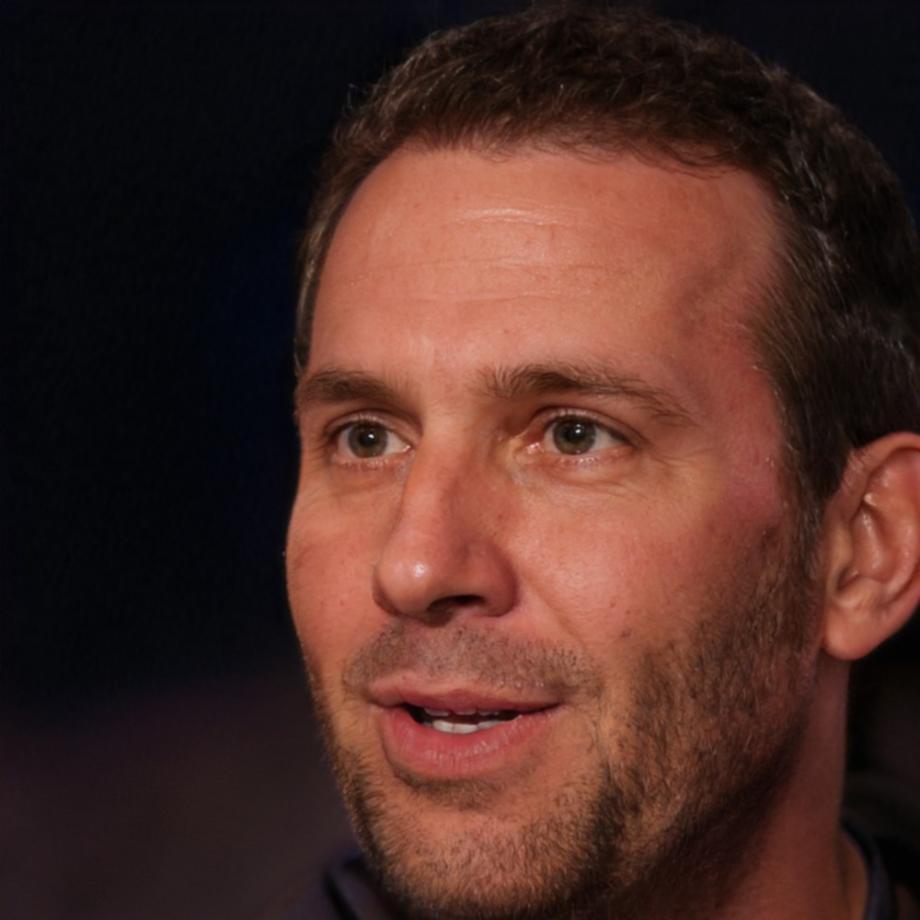

Henrik Tolberg

Independent Financial Consultant

Based in Central Singapore

Working with Casterina brings a structured approach to my clients' budget needs. Their attention to detail in cash flow projections helps my consulting practice deliver more accurate advice to small businesses navigating growth phases.

Rajiv Nayyar

Corporate Finance Advisor

Based in Marina Bay District

The collaborative work with Casterina streamlines the budget planning process for our corporate clients. Their methodology complements our advisory services well, particularly during quarterly planning cycles when businesses need reliable forecasting support.

Partnership Models That Actually Function

Some consultants prefer project-based collaboration where we handle specific budget planning engagements. Others work with us on an ongoing basis, bringing us in for quarterly reviews or annual planning cycles.

We don't force a particular partnership structure. Different practices have different needs. What matters is establishing clear expectations about communication, timelines, and deliverables from the start.

Typical Engagement Flow

When a consultant refers a client, we schedule an initial assessment to understand their budget situation. This usually takes one to two weeks, depending on the complexity of their financial operations and how readily they can provide documentation.

Partnership Statistics

- Regular communication protocols established with each partner

- Documented project templates for common engagement types

- Quarterly review meetings to discuss ongoing collaborations

- Referral tracking system for transparent partnership management

Supporting Independent Advisors

Many independent financial consultants run lean operations. They're excellent at client relationships and strategic advice, but specialized budget planning takes time they don't always have.

That's where our partnership becomes useful. We handle the detailed financial modeling and budget documentation while they maintain the primary client relationship. It's a division of labor that lets everyone focus on what they do best.

Resource Sharing Approach

We provide partners with documentation templates, budget planning frameworks, and reference materials they can use with their other clients. This knowledge transfer helps them recognize situations where specialized budget support might be beneficial.

Value for Partner Practices

- Detailed budget analysis completed within agreed timelines

- Client-friendly documentation that explains financial decisions

- Direct communication with referred clients when needed

- Feedback sessions after project completion for continuous improvement

Long-Term Collaboration Benefits

We've worked with some partners for over three years now. That continuity helps because we learn their communication style, understand their client base better, and can anticipate what kind of support their referrals typically need.

These longer relationships also mean we can be more flexible. When a partner has an urgent client situation, we know their practice well enough to prioritize appropriately. Trust builds over time through consistent delivery.

Growth Through Partnership

Several partners have expanded their own advisory services because they know they have reliable budget planning support. One consultant mentioned they now take on more complex engagements because they're confident we can handle the detailed financial work.

Partnership Longevity Metrics

- Annual partnership reviews to assess collaboration effectiveness

- Shared learning sessions about budget planning methodologies

- Priority scheduling for established partner referrals

- Collaborative problem-solving for complex client situations

Interested in Partnering With Us?

If you're a financial consultant or advisor looking for reliable budget planning support for your clients, let's discuss how we might work together. We're always open to building new collaborative relationships.

Get in Touch